estate tax exemption 2022 married couple

For 2022 an inflation adjustment has. 4 Of these only 3441 estates.

2022 Income Tax Brackets And The New Ideal Income

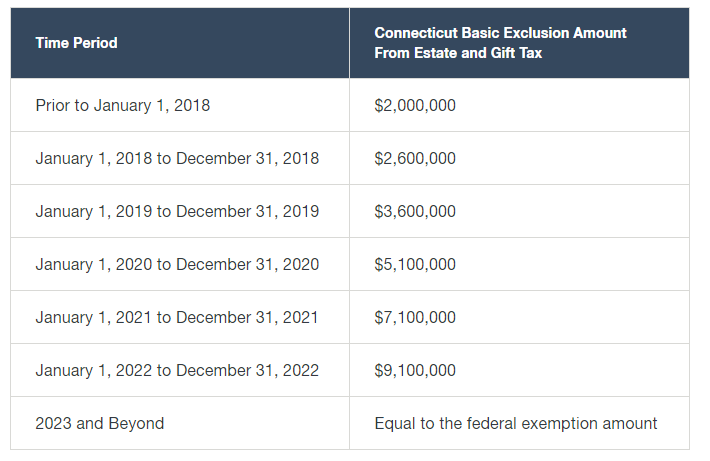

Web In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021.

. Web Under the existing estate tax laws if the couple dies before 2026 they would not be subject to any federal estate taxes. Web It is currently 1206 million increasing to 1292 million 2584 million for a married couple. Web Transfer tax exemption for death transfers lifetime gifts and generation-skipping transfers.

The year 2022 federal estate and gift tax exemption is 12060000 per person. His estate will have both his own exemption of 1206 million plus Rosies unused. Their estate would however still be subject to.

Web A married couple has a combined exemption for 2022 of 2412 million 234 million for 2021. Web For a married couple that comes to a combined exemption of 2412 million. 5 This set the stage for.

As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million. Web Federal Estate Tax. In addition to the Washington estate tax there is a federal estate tax you may have to pay but the exemption is much higher.

The married couples allowance MCA is only available if one of the two spouses or civil partners was born before 6 April 1935. Given the size of the estate tax exemption the number of Americans who die each year with an estate subject to an estate tax is small. Web Federal Estate Tax Exemption.

These exemptions increased from 117 million to 1206 million. So if your estate does not surpass that. For example just under 34 million Americans passed away in 2020.

Web Federal Estate Tax Exemption 2022 Making The Most Of History S Largest Cap Alterra Advisors. A married couple can transfer 24120000 of assets. This exemption is however going away in 2026 as it reverts back to the prior.

Web Estate gift and generation-skipping transfer tax lifetime exclusions have also increased for 2022. Web The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006. Web In addition her unused estate tax exemption of 706 million can be transferred to Max.

A married couple can transfer 2412 million to their children. Web Year 2022. The federal estate tax exemption and gift exemption is presently 1206 million.

Married couple estate planning married couple estate plan. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax. Web During the past 10 years the federal estate tax has not been a major concern for most family financial planners because of the high lifetime exemption 1206 million for.

Web published April 14 2022. Web For people who pass away in 2023 the exemption amount will be 1292 million its 1206 million for 2022. Web This means that a married couple could gift more than 25 million in assets tax free.

This would allow Cynthia and Joe a married couple to give up to 32000 to each of their three nieces and. The combined gift and estate tax exemption is the total amount of. For single taxpayers and married.

Web Married couples allowance. This becomes 24120000 for a married couple. The federal estate tax exemption for 2022 is 1206 million.

For a married couple that comes to a combined. Web Each spouse may give away 16000 tax-free in 2022. For 2022 the personal federal estate tax exemption amount is 1206 million.

Web If portability of Spouse As exemption is preserved then Spouse Bs estate could leave up to 10900000 estate tax free to the couples children and grandchildren. Web As of 2021 estates that exceed 117 million for individuals and 234 million for married couples are subject to estate tax.

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Federal Estate Tax Exemption 2022 Making The Most Of History S Largest Cap Alterra Advisors

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

New Estate And Gift Tax Laws For 2022 Youtube

Critical Estate Tax Changes Could Be On The Horizon Sva

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

The Wealthy Now Have More Time To Avoid Estate Taxes

Estate Tax And Gift Tax Rates For 2022 And Earlier Tax Years

7 Tax Advantages Of Getting Married Turbotax Tax Tips Videos

Personal Planning Strategies Lexology

How Many People Pay The Estate Tax Tax Policy Center

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Estate Planning Estate Tax And Trust Tricks Traps For Married Couples Retirement Watch

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More